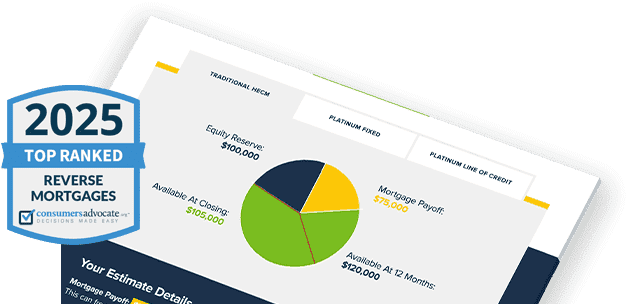

Get An Instant Online Estimate

Reverse Mortgage Calculator

§ By submitting your phone number and hitting the calculate button, you are providing express written consent to having Longbridge Financial LLC contact you at the phone number you have provided. You are authorizing Longbridge to send you automated messages and calls about our mortgage products and services at the phone number you have provided. You can reply STOP to opt-out of future messages at any time or HELP for help. Message and data rates may apply. Message frequency will vary based on use. You understand that your telephone company may impose charges on you for these contacts, and you are not required to enter into this agreement as a condition of any Longbridge products or services. You understand that you can revoke this consent at any time by calling Longbridge at 888-756-8676.

For more information, please see our Texting Terms and Conditions.

For information on how we collect and use personal information, please see our Privacy Policy.

This calculated amount is an estimate and does not include loan costs, lender credits or other programs that you may be eligible for. A reverse mortgage consultant can provide a more in-depth analysis based on your unique situation.

We're proud to support our US Military Active Duty and Veterans.

That's why we offer a $500 discount in honor of those who have served.†

By submitting your phone number and hitting the calculate button, you are providing express written consent to having Longbridge Financial LLC contact you at the phone number you have provided. You are authorizing Longbridge to send you automated messages and calls about our mortgage products and services at the phone number you have provided. You can reply STOP to opt-out of future messages at any time or HELP for help. Message and data rates may apply. Message frequency will vary based on use. You understand that your telephone company may impose charges on you for these contacts, and you are not required to enter into this agreement as a condition of any Longbridge products or services. You understand that you can revoke this consent at any time by calling Longbridge at 888-756-8676.

†Longbridge’s Military Discount Program is subject to change or cancellation at any time and without notice. This program offering is valid for a credit of up to $500.00 off allowable closing costs. This program offering can only be redeemed with Longbridge Financial LLC, and is available to U.S. military veterans, their spouses, and the spouses of deceased veterans. Documentation of military service is required; acceptable documents include DD214 Discharge papers, VA / military identity card, VA benefits summary/award letter for income, and the VA benefits letter. Loans must close and be funded with Longbridge Financial LLC as the lender in order to receive credit. The credit will be applied to the overall cost indicated on the HUD-1 Settlement Statement at the time of the closing. This offer is not available for Home Equity Conversion Mortgage for purchase transactions. This is not an offer to make you a loan, does not qualify you for a loan, and is not an official loan disclosure. Loan disclosures, including a Good Faith Estimate of closing costs, are provided upon receipt of a completed application. All loans are subject to approval. Program, rates, and additional terms and conditions apply and are subject to change without notice. Offer is not transferrable. This offer is not redeemable for cash or cash equivalents. Void where prohibited, taxed or restricted by law. Restrictions apply.

Here’s what people like you are saying about us.

The first question I had was, ‘How can you use a reverse mortgage?’ The short answer is, any way you want.

— LARRY

He’s right: tapping into your home equity with a reverse mortgage gives you many different options for enhancing your retirement plan. It gives you peace of mind for now, and financial protection for the future.

A Reverse Mortgage Lets You:

- Keep more money on hand to meet everyday bills and expenses

- Consolidate credit card balances or other debts

- Help with healthcare expenses

- Set aside funds to pay for future long-term care

- Make home updates, repairs, or modifications to help you live more comfortably

- Avoid making taxable withdrawals from 401(k) or other retirement plans by using reverse mortgage proceeds that are income tax-free1

- Establish a line of credit2 as a financial “safety net,” to prepare for unexpected expenses

- Or any other purpose

Questions you’ll want to consider before you apply for a reverse mortgage include:

- Do you need to tap into your home equity now, or can you save if for future needs?

- Are you on a fixed income, with no other assets?

- How long do you and your family plan to live in your home?

- Would your spouse want to keep living in the home without you?

At Longbridge, we can assess your situation and help you decide, along with your trusted advisors, which reverse mortgage solution is right for you. Not all lenders make that commitment.

Get your free reverse mortgage information kit to learn:

- What is a reverse mortgage and how does it work?

- What are the benefits of a reverse mortgage?

- How does a reverse mortgage compare to a traditional mortgage?

- How much can you receive?

- How can you receive the funds?

- How can it work as part of your retirement plan?

- What’s the reverse mortgage process?

Get your reverse mortgage quote and kit today: there’s no cost or obligation.

Watch this short video to learn more about How Reverse Mortgages Work

How Reverse Mortgages Work

Reverse mortgages have become a popular financial tool for homeowners aged 62 and older who are seeking a consumer loan. A reverse mortgage loan allows senior homeowners to access the equity they’ve built up in their home over the years. Unlike traditional “forward” mortgages, reverse mortgages do not require monthly mortgage payments. Homeowners will still be responsible for insurance, property taxes, and maintenance; however, loan repayment is deferred until the homeowner no longer lives in the home. Since monthly mortgage payments are not required,3 seniors typically use their reverse mortgage funds as income tax-free1 cash.

Homeowners who want to qualify for a reverse mortgage must be at least 62 years old and have equity available in their home. Reverse mortgages work by allowing homeowners to convert a portion of their home’s equity into cash, based on the total equity available in the home. Loan proceeds can be received in the form of a line of credit,2 monthly payments, a lump-sum, or any combination of these options. Several factors effect the loan amount which you may qualify for, including your home’s value, your age, and certain property requirements set by the Federal Housing Administration (FHA). You can read more about these requirements here.

- Consult a financial advisor and appropriate government agencies for any effect on taxes or government benefits.

Borrowers who elect a fixed rate loan will receive a single disbursement lump sum payment. Other payment options are available only for adjustable rate mortgages.

As with any mortgage, you must meet your loan obligations by keeping current with property taxes, insurance, and maintenance.